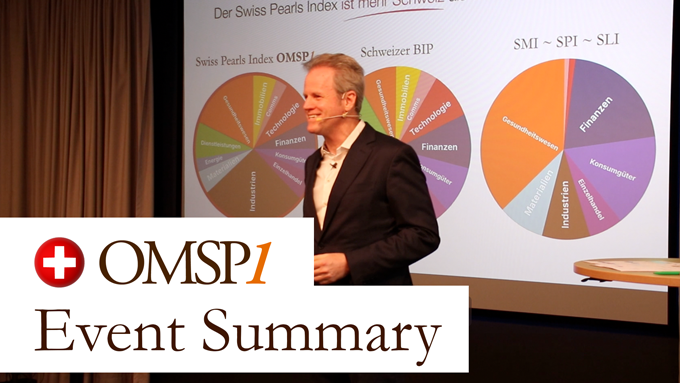

The Obermatt Method

Whether you're new to investing or have years of experience, you've likely encountered the same frustrating reality: traditional stock analysis often yields little helpful information. Analyst reports contradict each other, and financial media chase yesterday's stories. Meanwhile, private investors are left wondering which companies actually deserve their investment dollars. The Obermatt Method cuts through this confusion with a fundamentally different, and better, approach.

Read More