The Dow Jones Industrial Average (DJIA) is a barometer of the US economy, composed of 30 of the most significant and financially sound American companies. While it’s not as broad as the S&P 500, the Dow is widely followed and represents the performance of established, large-cap businesses across various sectors. The companies in the DJIA are often leaders in their respective industries, known for their stability and long-term growth potential.

In a market environment marked by interest rate uncertainty and the expectation of future rate cuts, large-cap US stocks like those in the Dow become particularly attractive. Lower interest rates generally lead to increased borrowing and spending by both consumers and corporations, which can boost corporate earnings and stock valuations. This makes stable, dividend-paying companies in the Dow an appealing option for investors seeking a safe haven and steady returns. The anticipation of rate cuts can also shift investor sentiment from riskier assets to more dependable, blue-chip stocks.

These stocks are particularly suitable for retail investors who prioritize stability and capital appreciation. These are not speculative investments but rather cornerstones of a well-diversified portfolio. They are for investors who want to invest in companies that have a proven track record, strong brand recognition, and a history of navigating various economic cycles. The Dow provides a way for individual investors to own a piece of America's most powerful corporations without having to evaluate and select each one individually.

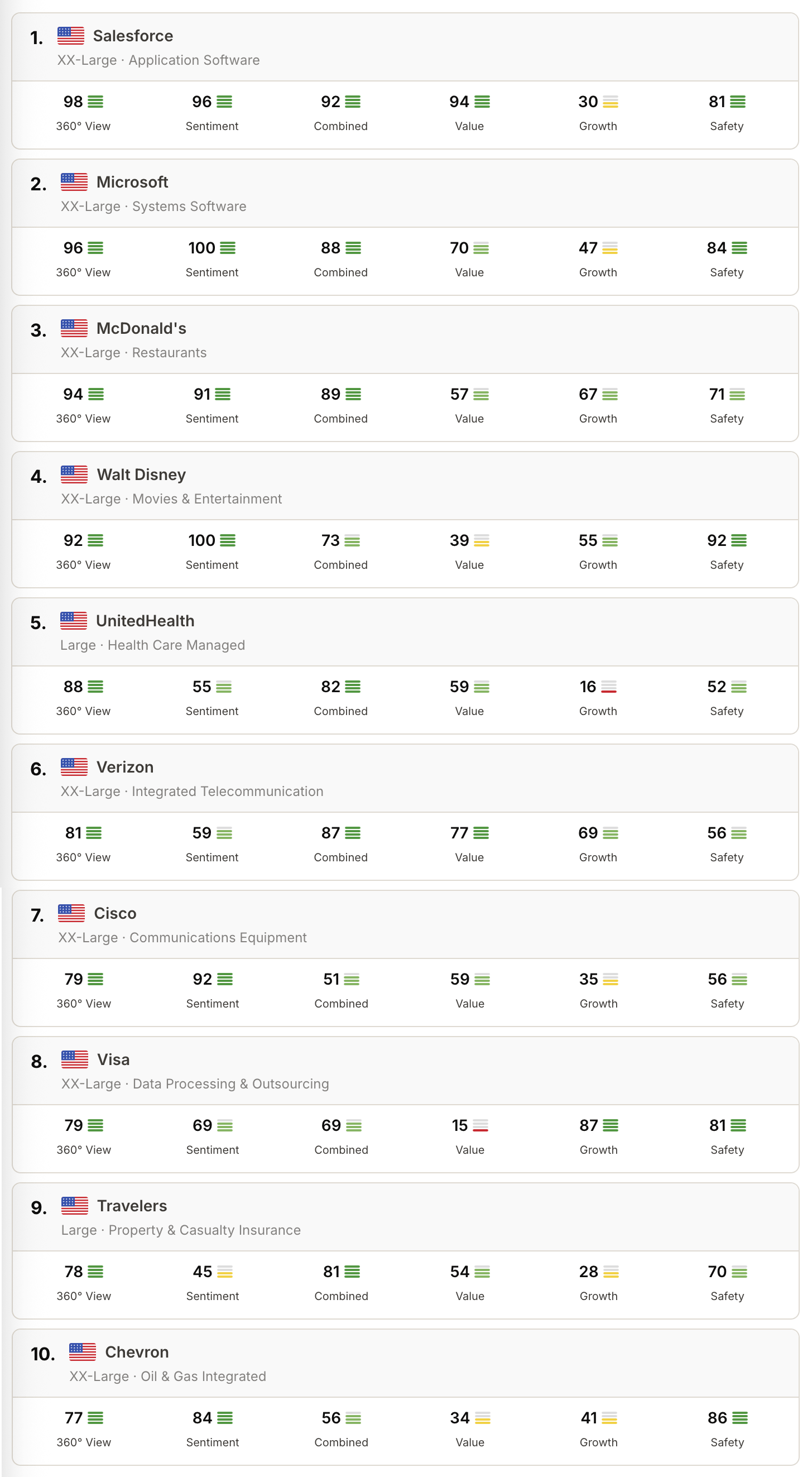

Here is a brief overview of the top 10 Dow stocks based on Obermatt’s 360° View:

- Salesforce (360° View rank: 98): A cloud-based software company that provides a suite of customer relationship management (CRM) services, including sales, customer service, marketing, and analytics applications. While the Growth rank is only 30, all other ranks look strong.

- Microsoft (360° View rank: 96): A multinational technology corporation that develops, manufactures, licenses, supports, and sells computer software, consumer electronics, personal computers, and related services. Despite a Growth Rank of 47, Microsoft is buoyed by a Sentiment Rank of 100.

- McDonald's (360° View rank: 94): The world's largest fast-food restaurant chain by revenue, primarily known for its hamburgers, cheeseburgers, and french fries. While the stock isn’t a bargain now with its Value Rank at 57, it faces strong growth and market sentiment.

- Walt Disney (360° View rank: 92): A diversified multinational mass media and entertainment conglomerate that operates in five main business segments: media networks, parks and resorts, studio entertainment, consumer products, and interactive media. With a Sentiment Rank of 100, it’s clear to see why Walt Disney’s stock price isn’t the best value at the moment (Value Rank: 39).

- UnitedHealth (360° View rank: 88): A multinational for-profit managed healthcare and insurance company that provides health care products and insurance services. UnitedHealth weighs in at 88, but watch out for its low Growth Rank of 16.

- Verizon (360° View rank: 81): A telecommunications company that is one of the largest wireless carriers in the United States, offering a wide range of mobile and broadband internet services. All ranks show green, but Sentiment and Safety are its weakest points.

- Cisco (360° View rank: 79): A technology conglomerate that develops, manufactures, and sells networking hardware, software, telecommunications equipment, and other high-tech services. Cisco’s Growth Rank is only 35, so only consider this stock if you prefer a solid, long term stock.

- Visa (360° View rank: 79): A multinational financial services corporation that facilitates electronic funds transfers throughout the world through its digital payment products. With a Value Rank of only 15, this stock is on the expensive side, though its 360° View comes in at 79.

- Travelers (360° View rank: 78): An American multinational insurance company that provides commercial property, casualty, and personal insurance products. A Growth Rank of 28 could be part of the reason the market isn’t hot on Travelers (Sentiment Rank: 45). Overall, it still comes in with a 360° View Rank of 76.

- Chevron (360° View rank: 77): A multinational energy corporation that is primarily involved in the oil and gas industry, from exploration and production to refining, marketing, and transportation. Safely financed (Safety Rank: 86) and popular (Sentiment Rank: 84), Chevron is on the expensive side as a stock.

Instead of every 6 months, Obermatt now publishes the Top 10 lists for more than 60 markets and indices on the 10th day of every month. Simply login to learn more about the stocks that top the list.