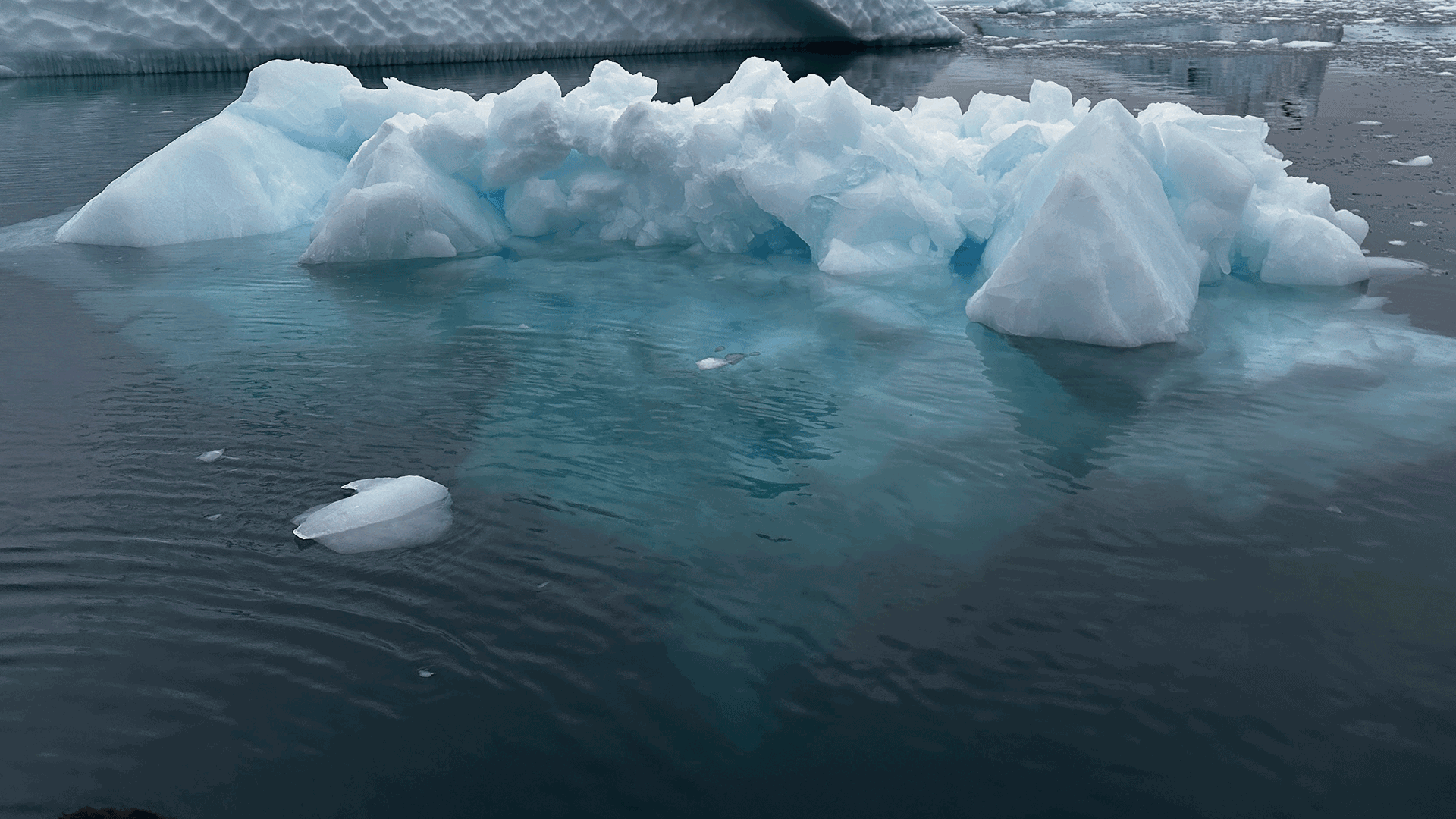

Earnings season often focuses your attention on the "tip" of the iceberg—the visible EPS headline. In a market currently trading at high multiples, these headlines generate immediate excitement. However, for the disciplined investor, structural safety provides the true anchor. While a profit surprise is what everyone talks about, it is the submerged mass of a company's financial health that prevents your portfolio from capsizing during a correction.

Learning from Past Cycles: The Lessons of 2000 and 2022

History shows us that "hollow" growth eventually meets a reckoning. In the late 1990s, the "tip" was user growth; in 2021, it was revenue at any cost. In both cases, when the interest rate environment shifted, the companies without a submerged anchor of safety were the first to disappear.

As we navigate the 2026 "rate-hold" phase, we are seeing a similar pattern. Companies are reporting earnings growth, but the cost of servicing their debt is silently rising beneath the surface. An earnings beat is a lagging indicator of past performance. To navigate this year successfully, you must prioritize the Obermatt Safety Rank - a leading indicator of structural resilience.

Analyzing the Submerged Metrics

To determine if a stock’s recent "beat" is backed by substance, evaluate these three submerged pillars of the balance sheet:

- Leverage (Debt-to-Equity): In the current interest rate environment, debt is no longer "cheap capital"; it is a significant operational burden. If you hold a company with an earnings "beat" but a Safety Rank in the bottom quartile, you are betting on a fragile foundation.

- Liquidity (Cash Flow-to-Debt): Profits can be massaged through accounting choices, but cash flow is a hard fact. This metric calculates how many years of operating cash it would take to retire total debt. A high rank suggests the company is "self-funding" and anchored by its own operations rather than the mercy of credit markets.

- Refinancing Strength (Working Capital-to-Equity): This represents the company's emergency anchor. It measures liquid assets available to cover short-term obligations. High-ranking companies can weather a sudden market freeze, whereas low-ranking peers are often the first to fail when liquidity dries up.

The volatility inherent in earnings season serves as a reminder that market sentiment is fleeting, but the balance sheet integrity is longer lasting. Success in the 2026 climate may require moving beyond the short-term metrics of EPS growth and focusing on the solvency of your holdings. By prioritizing the Safety Rank for preserving capital, you ensure that your portfolio is not merely reacting to the "tip" of the iceberg, but is anchored by the substance beneath it.