Our Blogs

Explore stock insights and build your investing knowledge. Our investing blogs and stock tips help you make

informed decisions with confidence.

OMSP1: VAT Group - The "Gatekeeper" of the AI Revolution

29 Jan 2026

Everyone talks about NVIDIA. But almost no one talks about the Swiss engineering that makes NVIDIA’s

chips possible. Modern AI processors require a production environment of absolute purity—a technical

challenge that VAT Group solves more effectively than any competitor globally.

Read More

OMSP1: Bell Food Group - More than just meat

1 Jan 2026

Bell Food Group is known for meat, but there is more to it. The company is evolving into a

comprehensive

food service provider, focusing on convenience and sustainability to meet changing consumer demands.

Read More

OMSP1: VZ Holding Rides the Pension Wave

27 Nov 2025

VZ Holding is the winner of the retirement wave. The financial service provider benefits from

demographic

trends and has a unique business model that capitalizes on the growing need for retirement planning and

asset management in Switzerland.

Read More

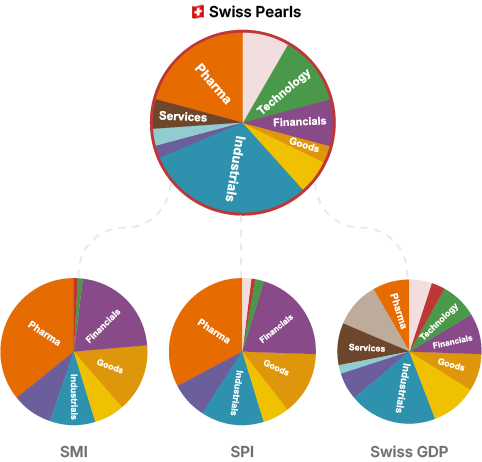

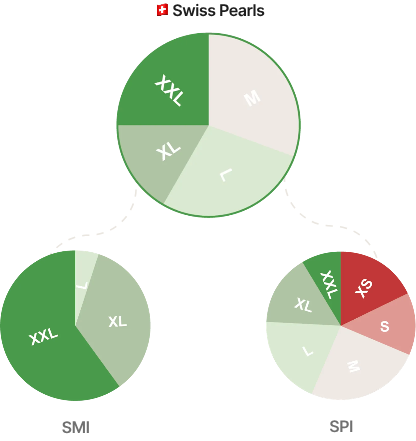

better diversification than the SMI or

SPI

better diversification than the SMI or

SPI