Embracing Market Dips – A Paradoxical Benefit

It’s in humans’ nature to dread negative things such as market downturns. Yet counterintuitively, falling stock prices are a gift for long-term investors. The ups and downs of the stock market are beneficial for those investing at regular intervals over time. As the Obermatt Investing Handbook notes, when you invest consistently, “the lows will give you more stocks for your money than what you lose on the highs”. In fact, without those ups and downs, long-term investors would likely end up with less wealth, not more. Volatility isn’t a risk to be avoided but an opportunity to be embraced. Crashes let you accumulate more shares cheaply and reap greater rewards later. This phenomenon, short-term pain yielding long-term gain, underpins the gift of falling prices.

The Simple Logic Behind This Paradox

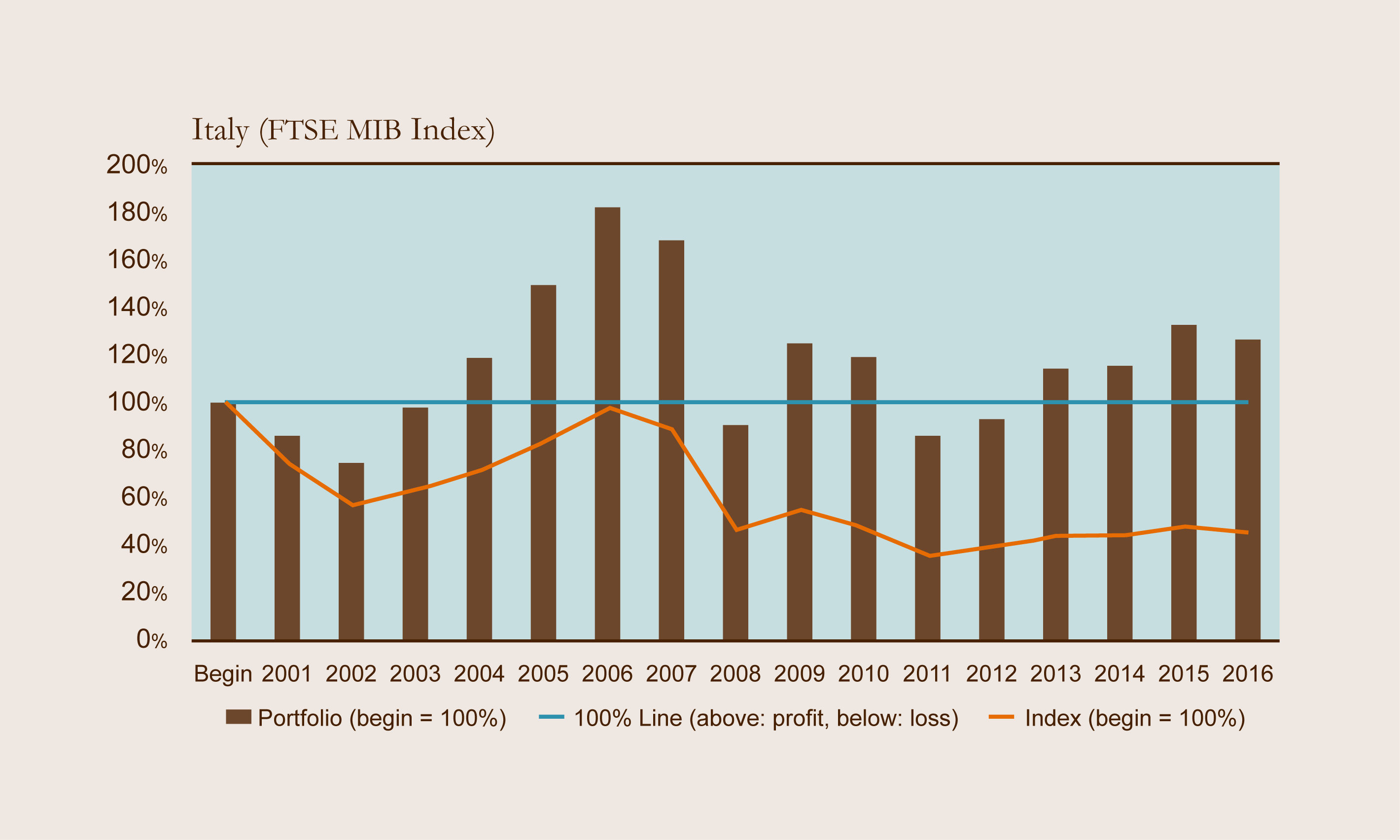

The apparent paradox comes from dollar-cost averaging: you invest a fixed amount of cash at regular intervals, so when the price is low, you buy more shares and when it’s high, you buy fewer. Your personal return is driven by the average cost per share you paid, not by the simple “start-to-finish” move of the index. Let’s take a look at a real-life example. The Italian stock market (FTSE MIB) is a poster child for underperformance and is often regarded as one of the worst markets in which to invest. It dropped about 60% between 2000 and 2016, which is a horrendous performance. But here's the thing: someone who consistently DCA'd into it still made a 20% return. How is this possible? Consider this: if a stock drops 50%. It needs a 100% gain to get back to its starting point. If you had invested before the crash, and at the low point of the crash, you would get a 100% return on the shares you bought at the bottom and a 0% return on the shares you bought before the crash. You average that out and have a total 50% return, even though the stock only returned to its starting position. That is significantly better than simply holding the stock or panic-selling.

- Buying Low: When prices are down, your fixed investment buys more shares.

- Averaging Down: This lowers your average cost per share.

- Offsetting losses: Because you bought more shares, you're able to offset the loss from shares bought at a higher price.

Brown Bars = Assets in percent of previously invested amount

Orange Line = Development of the index

”Slowly In, Slowly Out” – The Obermatt Way

The success of investing through falling prices hinges on patience and discipline. The Obermatt handbook emphasizes two golden rules for safe investing. The first is: “Slowly in, slowly out – that’s what safe investing is all about.” Instead of trying to time the market with big, sporadic trades, you invest small amounts regularly over time – and likewise, withdraw gradually when needed. The benefit of investing, for example, only 50% in the stock today, and then the rest in a few months, is that it increases your cash position. The benefits of this are two-fold: When prices increase, you benefit from the stocks you already hold. And when they fall, you can use your cash position to buy stocks cheaper. In practice, this means adhering to a plan (e.g., investing monthly or quarterly) across all market conditions and maintaining a cash position of 5-20%. By spreading your entries and exits over time, you reduce the risk of unfortunate timing and ensure you have the ability to capitalize on market dips and upswings.

The second Obermatt rule is just as vital as investing regular amounts at regular intervals: don’t put all your eggs in one basket. In practice, that means owning not only many shares, Obermatt recommends at least 20-30, but also ensuring those shares are invested in different industries and, just as importantly, different parts of the world. A portfolio that spans continents is far less likely to suffer a lengthy slump everywhere at once. Yes, the U.S. market has been the star performer for decades, and that success has pushed American shares to a hefty premium. However, no one can say with certainty that the U.S. will continue to lead forever; history is full of top-dog markets that later fell behind (Dutch Empire, British Empire). By holding stocks across multiple regions alongside the U.S., you give yourself multiple engines of growth. When one region stalls, another can pick up speed, smoothing your returns and preventing your future from hinging on a single country’s fortunes. In short, diversification doesn’t just lower risk, it frees you from having to guess which economy will win the next decade.

Turning Dips into Gains – The Long View

Market dips can indeed be gifts to the patient investor. The counterintuitive but well-proven reality is that falling prices lay the groundwork for higher future returns. By investing “slowly in, slowly out” over many years, diversifying broadly, and reframing volatility as opportunity, you put the math of dollar-cost averaging on your side. Short-term declines increase your future upside by boosting the number of shares you own and lowering your average cost. Whether it was the aftermath of 1929, the “lost decade” of the 2000s, or the turbulent 2020s, those who consistently invested during the bad times have often come out ahead of those who sat on the sidelines. The key is trusting the process and not interrupting it with impulsive reactions.

Every bear market in history has eventually given way to new highs. While past performance doesn’t guarantee future results, human progress and corporate earnings tend to march upward over the long run. As an investor, your job is not to predict the next downturn, but to weather it and capitalize on it. This means having the courage to keep investing when prices are down and everyone else is fearful. It also means having the humility to accept that you won’t time the market perfectly, and that you don’t need to. By dollar-cost averaging and staying invested, you ensure you’ll capture the recovery whenever it comes. Even if the market remains down for an extended period, you’ll be accumulating assets at bargain prices, positioning yourself for sizable gains down the road.